Hollywood doesn’t just have to worry about what plays in Peoria anymore. It has to worry about what plays in Peru. Box-office markets over the next few years are expected to grow more quickly abroad than in North America, where receipts have been relatively flat and are forecast to expand only modestly. That dynamic already is changing the way movies get made in Hollywood, as studios focus on big-tent productions like superhero epics that play across borders, or find story lines they know will fly in censorious countries. The Wall Street Journal used analysis by PricewaterhouseCoopers to give a fuller picture of the five fastest-growing box-office markets around the world. Here is a look at those markets and what is fueling their rise.

China within a few years is expected to surpass the U.S. as the world’s top box-office market thanks to a potent combination: a growing middle class and an appetite for more movies. “There are 125 screens per million people in the U.S. There are 23 screens per million people in China,” says Cecilia Yau, a partner in the entertainment and media practice at PwC’s Hong Kong office. Companies are constructing more theaters at a rapid clip, moving beyond major hubs like Shanghai to third- and fourth-tier cities getting their first multiplex. Consumers in those rural markets are drawn to local productions starring Chinese actors, which is expected to result in more homegrown productions. Although Hollywood studios typically receive a lower proportion of revenue from Chinese theaters —about 25% compared with a 50/50 split in the U.S.— recent stateside hits such as “Furious 7” grossed even more in China, while domestic duds like “Warcraft” raked in Chinese ticket sales. As China gradually surpasses the U.S. in box-office dominance, major movies may start to look more like convergent productions built to serve both markets. A great test of the markets’ commingling will come in February with the release of “The Great Wall,” a co-production between Le Vision Pictures and China Film Group Corp. in China and Comcast Corp.’s Universal Pictures in the U.S.

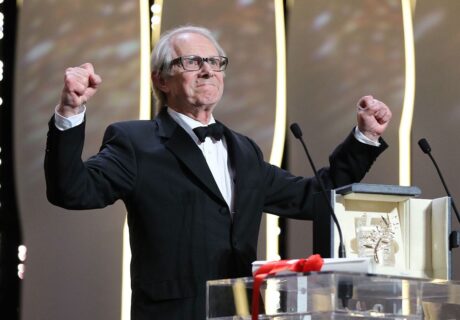

Although in the midst of an economic crisis, Venezuela is one of several countries in Latin America forecast to register significant box-office growth through 2020. The film industry in Venezuela began expanding around the time of President Hugo Chávez’s death in 2013. That progress became apparent in 2015 when “From Afar,” by Venezuelan director Lorenzo Vigas, won the top honor at the Venice Film Festival. Picked up for distribution in the U.S. by Strand Releasing, “From Afar” is a controversial story about a gay relationship between a middle-age man and a Caracas teenager. Economic troubles have hampered recent growth in Venezuela’s box-office receipts. Oil prices have plummeted and out-of-control inflation has made groceries hard to afford, let alone movie tickets. Still, analysts expect box-office receipts to register growth over the long term, nearly doubling to 227 million by 2020 from 2015.

India’s booming Bollywood has filled theaters for decades, building a loyal audience that has had relatively little interest in Hollywood imports. The hundreds of Bollywood titles produced each year have until recently followed a similar distribution pattern: released in major cities, and then trickled out to smaller markets. Digital distribution, which allows studios to disseminate hundreds of copies of a movie at once, is changing that and will fuel much of the market’s growth over the next several years, says Smita Jha, an executive in PwC India’s Entertainment and Media Practice. A “wide release” in the past meant about 700 prints of a film were made. But for the same cost, studios today can release about 3,000 digital prints simultaneously in theaters throughout the country—a practice that clamps down on the pirated copies that often appear when a movie takes several weeks to expand its footprint. India’s fame factory, which has produced crossover stars like “Quantico” actress Priyanka Chopra, also is being retooled. Producers used to spend about 70% of a production’s budget on the salaries of a film’s biggest stars, says Ms. Jha, but now more of that money is being directed to smarter marketing and distribution strategies.

Procter e Gamble’s Pantene brand is probably best known for making shampoo, but it also produces movies in Peru. It is one of many companies outside of the entertainment industry contributing to what is expected to be significant box-office growth in Peru. Peruvian filmmakers have turned to these businesses to help fund their movies, a trend that started with the 2013 comedy “Asu Mare,” which had 80% of its $700,000 production budget covered by private companies and sponsors. The success of “Asu Mare” encouraged other companies to jump in, says Francisco Pinedo, a partner with PwC’s Peru office. Consumer-products firm Gillette Co., along with PeG’s Pantene and Oral-B brands, helped produce “A los 40,” a comedy about some adults attending a college reunion. “Perro Guardián,” a 2014 vigilante drama, was backed by El Comercio, a newspaper, and Promart, a home-goods seller. A similar approach already is being explored by U.S. companies such as PepsiCo Inc., which has created an in-house development division and is working on a music movie with rapper Tip “T.I.” Harris.

Nigeria’s film industry —called “Nollywood”— isn’t well-known, but it produces the second-largest number of films by volume in the world annually after India’s. Most Nollywood movies are cheaply made features watched on mobile phones or pirated DVDs. There is some statistical evidence that nine in 10 movies watched in Nigeria are pirated copies, says Vicky Myburgh, an executive in PwC’s South Africa Entertainment and Media practice. Nigerian investors, some backed by government support, are trying to move viewing habits to the theaters, putting more money into local productions, hoping an improvement in quality can lead to more Nollywood titles on big screens in Nigeria alongside Hollywood movies. Filmhouse Cinemas and Silverbird Group, a Nigeria real-estate conglomerate, have said they plan to build hundreds of screens in the next 10 years. Meanwhile, a growing expatriate community in Europe and North America has created audiences for the Nollywood movies on global streaming services such as Netflix Inc., Ms. Myburgh says.